Grand Potentate

Supporter of Possible Sexual Deviants

- Messages

- 39,174

https://www.insurancejournal.com/news/national/2018/10/08/503575.htm

Employees’ Share of Health Costs Continues Rising Faster Than Wages

October 8, 2018 by John Tozzi

Annual family premiums for employer-sponsored health insurance rose five percent to an average $19,616 this year, extending a seven-year run of moderate increases.The average single deductible now stands at $1,573 for those workers who have one, similar to last year’s $1,505 average. On average, workers this year are contributing $5,547 toward the cost of family coverage, with employers paying the rest.

Those findings are from the 2018 benchmark Kaiser Family Foundation Employer Health Benefits Survey. About 152 million Americans rely on employer-sponsored coverage.

Annual premiums for single coverage increased three percent to $6,896 this year, with workers contributing an average of $1,186 according to the same survey.

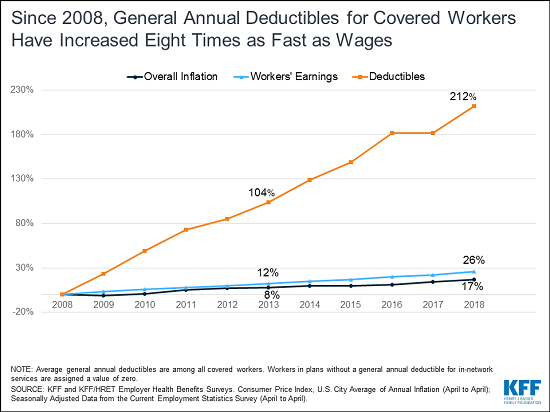

This year’s premium increases are comparable to the rise in workers’ wages (2.6%) and inflation (2.5%) during the same period. Over time, the increases continue to outpace wages and inflation. Since 2008, average family premiums have increased 55 percent, twice as fast as workers’ earnings (26%) and three times as fast as inflation (17%).

Deductibles paid by workers continue to climb over time in two ways: a growing share of covered workers face a general annual deductible, and the average deductible is rising for those who face one.

“Health costs don’t rise in a vacuum. As long as out-of-pocket costs for deductibles, drugs, surprise bills and more continue to outpace wage growth, people will be frustrated by their medical bills and see health costs as huge pocketbook and political issues,” KFF President and CEO Drew Altman said.

Currently 85 percent of covered workers have a deductible in their plan, up from 81 percent last year and 59 percent a decade ago. The average single deductible now stands at $1,573 for those workers who have one, similar to last year’s $1,505 average but up sharply from $735 in 2008. These two trends result in a 212 percent total increase in the burden of deductibles across all covered workers.

Looked at another way, a quarter (26%) of all covered workers are now in plans with a deductible of at least $2,000, up from 22 percent last year and 15 percent five years ago. Among covered workers at small firms (fewer than 200 workers), 42 percent face a deductible of at least $2,000.

“Deductibles of $2,000 or more are increasingly common in employer plans, which means the bills can pile up quickly for workers who require significant medical care,” said study lead author Gary Claxton, a KFF vice president and director of the Health Care Marketplace Project.

Employers Offering

The survey finds 57 percent of employers offer health benefits, similar to the share last year (53%) and five years ago (57%). Employers that do not offer health benefits to any workers tend to be small, and nearly half (47%) cite cost as the main reason they do not offer health benefits.

Some employers that offer health benefits provide financial incentives to workers who don’t enroll –either for enrolling in a spouse’s plan (13%) or otherwise opting out of their employer plan (16%).

The survey also probes employers’ expectations about how the 2017 tax law, which eliminated the Affordable Care Act’s tax penalty for people who do not have health insurance, would affect enrollment in employer coverage in future years. Overall 10 percent of all offering firms – and 24 percent of large ones – expect fewer workers and dependents to enroll because of the elimination of the tax penalty.

Among large firms that offer health benefits, one in five (21%) report they collect some information from workers’ mobile apps or wearable devices such as a FitBit or Apple Watch as part of their wellness or health promotion programs. That’s up from 14 percent last year.

Most large offering employers (70%) provide workers with opportunities to complete health risk assessments, which are questionnaires about enrollees’ medical history, health status, and lifestyle, or biometric screenings, which are health examinations conducted by a medical professional, or both. Thirty-eight percent of large offering firms provide incentives for workers to participate in these programs. The maximum financial incentives for these and other wellness programs often total $500 or more.

Other survey findings include:

Source: Kaiser Family Foundation

Employees’ Share of Health Costs Continues Rising Faster Than Wages

October 8, 2018 by John Tozzi

Annual family premiums for employer-sponsored health insurance rose five percent to an average $19,616 this year, extending a seven-year run of moderate increases.The average single deductible now stands at $1,573 for those workers who have one, similar to last year’s $1,505 average. On average, workers this year are contributing $5,547 toward the cost of family coverage, with employers paying the rest.

Those findings are from the 2018 benchmark Kaiser Family Foundation Employer Health Benefits Survey. About 152 million Americans rely on employer-sponsored coverage.

Annual premiums for single coverage increased three percent to $6,896 this year, with workers contributing an average of $1,186 according to the same survey.

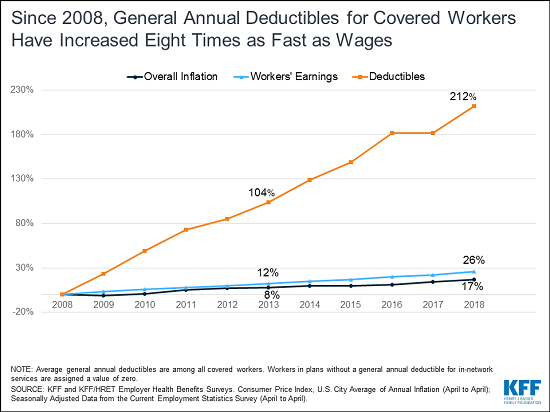

This year’s premium increases are comparable to the rise in workers’ wages (2.6%) and inflation (2.5%) during the same period. Over time, the increases continue to outpace wages and inflation. Since 2008, average family premiums have increased 55 percent, twice as fast as workers’ earnings (26%) and three times as fast as inflation (17%).

Deductibles paid by workers continue to climb over time in two ways: a growing share of covered workers face a general annual deductible, and the average deductible is rising for those who face one.

“Health costs don’t rise in a vacuum. As long as out-of-pocket costs for deductibles, drugs, surprise bills and more continue to outpace wage growth, people will be frustrated by their medical bills and see health costs as huge pocketbook and political issues,” KFF President and CEO Drew Altman said.

Currently 85 percent of covered workers have a deductible in their plan, up from 81 percent last year and 59 percent a decade ago. The average single deductible now stands at $1,573 for those workers who have one, similar to last year’s $1,505 average but up sharply from $735 in 2008. These two trends result in a 212 percent total increase in the burden of deductibles across all covered workers.

Looked at another way, a quarter (26%) of all covered workers are now in plans with a deductible of at least $2,000, up from 22 percent last year and 15 percent five years ago. Among covered workers at small firms (fewer than 200 workers), 42 percent face a deductible of at least $2,000.

“Deductibles of $2,000 or more are increasingly common in employer plans, which means the bills can pile up quickly for workers who require significant medical care,” said study lead author Gary Claxton, a KFF vice president and director of the Health Care Marketplace Project.

Employers Offering

The survey finds 57 percent of employers offer health benefits, similar to the share last year (53%) and five years ago (57%). Employers that do not offer health benefits to any workers tend to be small, and nearly half (47%) cite cost as the main reason they do not offer health benefits.

Some employers that offer health benefits provide financial incentives to workers who don’t enroll –either for enrolling in a spouse’s plan (13%) or otherwise opting out of their employer plan (16%).

The survey also probes employers’ expectations about how the 2017 tax law, which eliminated the Affordable Care Act’s tax penalty for people who do not have health insurance, would affect enrollment in employer coverage in future years. Overall 10 percent of all offering firms – and 24 percent of large ones – expect fewer workers and dependents to enroll because of the elimination of the tax penalty.

Among large firms that offer health benefits, one in five (21%) report they collect some information from workers’ mobile apps or wearable devices such as a FitBit or Apple Watch as part of their wellness or health promotion programs. That’s up from 14 percent last year.

Most large offering employers (70%) provide workers with opportunities to complete health risk assessments, which are questionnaires about enrollees’ medical history, health status, and lifestyle, or biometric screenings, which are health examinations conducted by a medical professional, or both. Thirty-eight percent of large offering firms provide incentives for workers to participate in these programs. The maximum financial incentives for these and other wellness programs often total $500 or more.

Other survey findings include:

- High-deductible health plans with savings option. The survey finds 29 percent of firms that offer health benefits offer a high-deductible health plan with a savings option – a plan that either can work with a Health Savings Account or is linked to an employer-created Health Reimbursement Arrangement. Most (61%) of those firms offer only this type of plan to at least some of their workers. Overall, 29 percent of covered workers are enrolled in such plans.

- Telemedicine. About three quarters (74%) of large offering firms (at least 200 workers) cover services provided through telemedicine, such as video chat and remote monitoring, which allow a patient to get care from a provider at a remote location. That’s up from 63 percent last year and 27% in 2015. A separate analysis also released today suggests very few workers are using telemedicine services in place of traditional in-person physicians visits, as less than 1 percent of all enrollees in large employer health plans used any telemedicine services in 2016.

- Retail health clinics. Similarly, three quarters (76%) of large offering firms cover services received in retail clinics, such as those located in pharmacies, supermarkets and other retail stores. A small share also provide financial incentives for workers to use these clinics.

Source: Kaiser Family Foundation